Indonesia Palm Oil Export 2019

Jakarta (AGRINA-ONLINE.COM). The year of 2019 has been a challenging year for Indonesian Palm Oil Industry.

The Implementation of Renewable Energy Directive (RED) II by EU has removed palm oil from the raw material of biodiesel, the increase on import duty cost for Indonesian Palm Oil product to India, prolonged drought, the US - China trade war and constant decline on the price of CPO are the main challenges faced by Palm Oil Industry in 2019.

Trade war between the two nations has constrained the export of soy from the US to China. It drove many farmers in USA to search for alternate markets that led to the decline on the oilseed and other vegetable oil’s price.

However, there’s an important moment that happened in 16th August 2019, in which President Jokowi made a statement in his speech that Indonesia will consume more palm oil for domestic needs, especially biodiesel. As a result the average Kharisma Pemasaran Bersama Nusantara (KPBN) price for CPO kept jumping from US$ 483, 497, 582, up to 651 per ton on the period of September-December 2019.

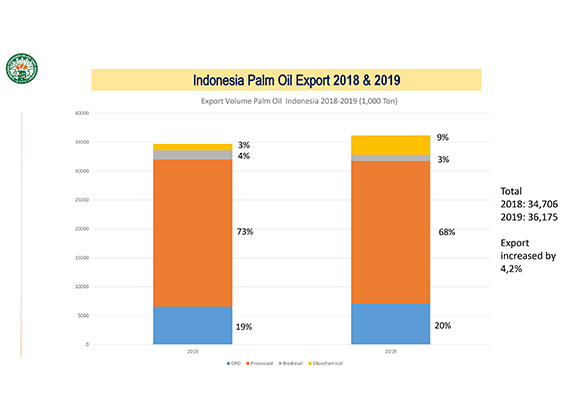

Joko Supriyono, Chairman of Indonesian Palm Oil Association (GAPKI) in yesterday’s press conference said, “CPO production in 2019 reached 51.8 million ton or about 10% higher from the production in 2018. At the same time, domestic consumption has risen to 24% or 16.7 million ton with the increase of biodiesel consumption by 49%, food went up for 14% and increase in oleochemical for 9%. The export volume in palm oil for 2019 is 35.7 million ton, which is a 4% increase from 2018 export.”

Total export value of palm oil products, especially oleochemical and biodiesel in 2019 have been reported to reach US$19 billion. The current export price is 17% lower than the previous year. Total export value of palm oil products for 2018 was US$23 billion.

Aside from oleochemical and Indonesian biodiesel, the main export destinations of palm oil in 2019 were China (6 million ton), India (4.8 million ton), EU (4.6 million ton). In the category of oleochemical and biodiesel, the biggest export destinations were China (825 thousand tons) followed by EU (513 thousand tons). The rising trends on Indonesian palm oil export to Africa with an increase in 11% on 2019 from 2.6 million tons on 2018 to 2.9 million tons gives a positive sign for the Indonesian palm oil market.

The challenging year of 2019 was ended with a price that jumped above US$ 800 per ton CIF Rotterdam and the adjustment of import duty for Indonesian palm oil product export in India. Among oil palm growers, the brighter financial situation should have been seen as a chance for funding their plantation and infrastructure restoration. The preparation for B30 implementation in the end of 2019 worried importers regarding the possible decline in Indonesian palm oil supply for export.

Prospect for 2020

With a better climate condition and higher price for the commodity, the beginning of 2020 has been a good start for Indonesian palm oil. According to the Indonesian Meteorology, Climatology, and Geophysical Agency, the climate (BMKG) in 2020 would have become more stable compared to 2019. Dry season is predicted to start in the month of April-May.

The government commitment in the implementation of B30 on 2020 showed the world that Indonesia is very committed and thus the impact on world’s vegetable oil market and the domestic oil market would be unstoppable. In 2020, the domestic needs for biodiesel is predicted to reach 8.3 million ton, thus affecting the number of palm oil supply available for import.

Despite of the unstable world’s economic condition in 2020; heated political situation in Middle East, the prolonged US-China trade war, EU’s sustainability demand; the rising domestic biofuel consumption, the increasing number of Indonesian Sustainable Palm Oil (ISPO) certified company and the opening of new export destinations would guarantee the Indonesian palm oil in global market, thus GAPKI views the prospect of Indonesian palm oil industry with a positive outlook.

With the challenges available on the international and Indonesian market in mind and the business situation that demands a higher number of investments, the palm oil stakeholder’s work program in 2020 needs to focus more on:

1. Increasing productivity by evaluating growing technique or replanting

2. Encouraging ISPO implementation

3. Aiming for new exports destinations and managing the trading obstacles in global market.

4. Disseminating positive palm oil campaign directed towards Indonesian and other countries targeted for palm oil export.

“By paying attention to the opportunities and challenged faced in 2020 along with the government’s support for the palm oil industry, GAPKI is optimistic that palm oil industry will be better in 2020,” Mr. Supriyono concluded in Jakarta (Feb 3, 2020).

Peni SP